Certified Public Accountant

4 Exams | 8–12 Months | 94% Pass Rate

4 Exams | 8–12 Months | 94% Pass Rate

The US CPA is one of the most prestigious credentials in accounting and finance, building expertise in audit, taxation, and financial management. Recognized in over 130 countries, it unlocks global opportunities with Big 4 firms, Fortune 500 companies, and beyond. More than a qualification, it’s your passport to a high-growth international career.

Kind words from our successful students

I used Board360 for all four sections, and it became my main study tool. I liked that I could set my own pace and track exactly where I needed improvement. The combination of videos, quizzes, and full-length mocks made studying less stressful. If I had one tip for future students, it’s to make sure you don’t just watch the videos—actively take notes and practice questions, because that’s where you really learn.

Auditing always felt abstract to me, but Board360 breaks it down into simple, understandable steps. The examples and simulations felt close to what’s on the real exam. I especially liked tracking my weak areas so I could focus my study time efficiently. One thing I learned is that repeated practice is key—watching videos isn’t enough; you have to do the questions too.

BEC was tricky for me, especially the cost accounting and internal controls parts. Board360’s tutorials are great for explaining concepts in simple language. The practice problems and simulations are realistic, and I liked that they included tips for the written communication section. I wish there were more examples for business law, but overall, it gave me everything I needed to pass.

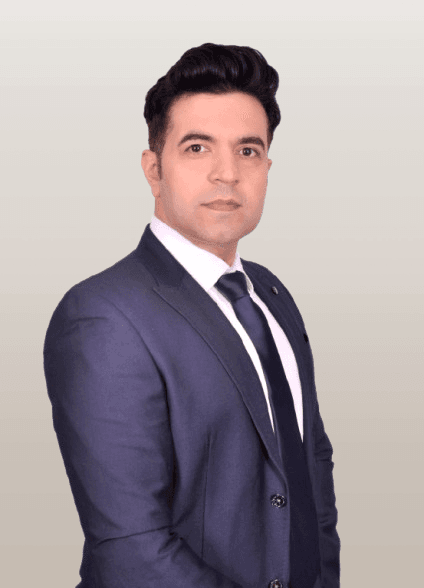

The mentorship and exam-focused guidance at Board360 made CPA preparation more manageable. The real-world examples really strengthened my understanding.

At BOARD360, learning isn’t just about passing exams — it’s about unlocking global opportunities with the right tools, mentors, and community. From world-class UWorld content to real-time collaboration, we make your CPA journey smarter, simpler, and more engaging.

AICPA-aligned questions, clear explanations, and smart tools trusted by 2M+ learners worldwide.

Get guidance from seasoned CPAs and mentors for concepts, strategy, and career growth.

Access accurate, board-approved resources in one organized place.

Easily book 1:1 sessions, doubt-clearing classes, and mentoring slots.

Safely store and share notes, resources, and assignments.

Engage with peers, share knowledge, and learn together anytime.

Trusted by 4M+ learners worldwide to achieve exam success.

Study Smart. Learn faster. Score higher.

Free TrialWe have redefined CPA prep. With our award-winning study tools, you will grasp even the most complex accounting topics. Our focus is on helping you understand, apply, and retain, not just memorize.

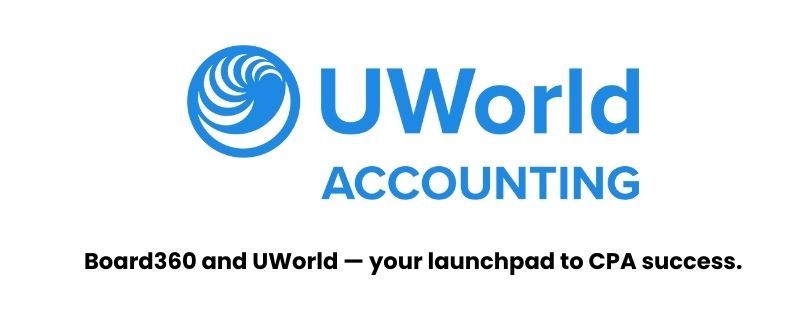

UWorld's SmartPath Predictive Technology tells you exactly when you're ready for the exam, no second-guessing.

Over 4 million learners across the globe — from doctors to accountants — trust UWorld. With practical questions and clear explanations, it makes tough concepts simple and helps you feel truly exam-ready.

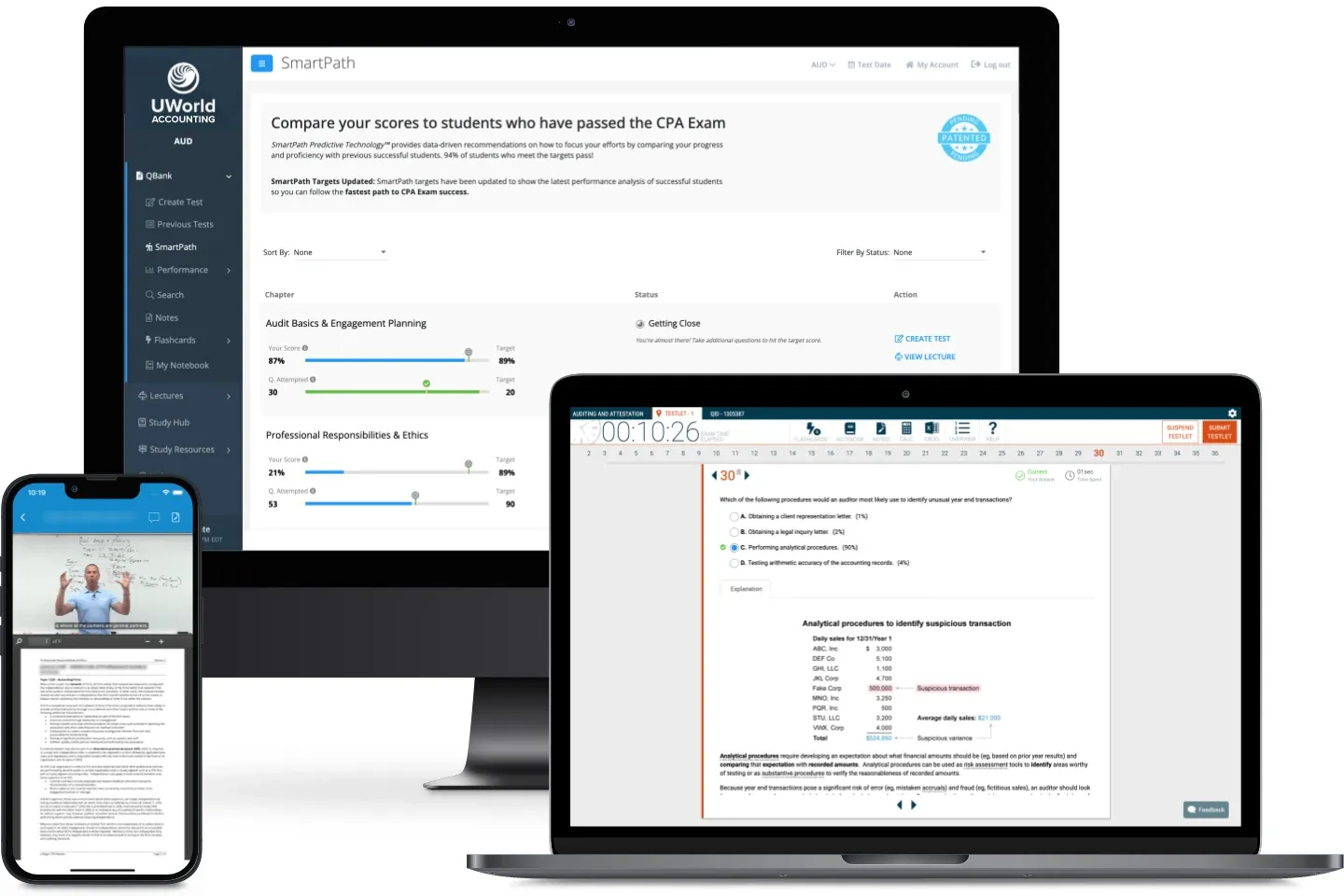

Learn from legendary instructors like Roger Philipp and Peter Olinto, who bring decades of teaching excellence, real-world expertise, and unmatched energy to the classroom.

Tough concepts? No problem. UWorld's questions and answers come with detailed explanations, illustrations, diagrams, flowcharts, and most importantly, real-world CPA insights.

Designed by CPAs for CPAs-in-the-making, our tools include features such as adaptive learning tech, instant performance tracking, and real-time progress feedback.

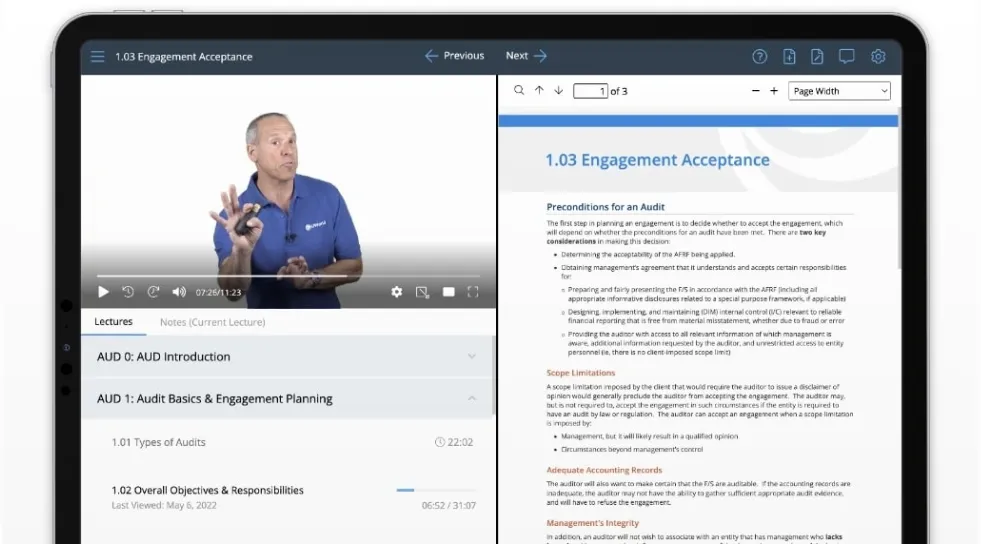

No fluff—just what matters. UWorld's CPA study guides are expertly curated, making complex topics easy to understand and quicker to master.

Study anytime, anywhere- on your commute, in between meetings, or from your couch. All features, all access, all the time.

Practice with thousands of AICPA-aligned questions, written by CPAs and reviewed by expert educators. Each question comes with detailed explanations and concept breakdowns, reinforced through customizable flashcards, annotated notes, and quick-review tools to strengthen your learning.

Prepare smarter with customizable flashcards, pre-annotated notes, and a built-in highlighter—perfect for last-minute reviews.

High-quality questions and detailed answer explanations – written by practicing CPAs and accounting educators – include vivid illustrations, diagrams, flowcharts, and tables that provide immediate feedback and bring tough CPA Exam topics to life.

You can make up the remaining credits with NAAC-accredited bridge courses tailored to meet US CPA standards.

Minimum Credits Required (Total): 120

After passing all four exams, candidates must meet additional requirements to earn their CPA license:

1–2 Years of Relevant Work Experience

Ethics Exam (State-Specific)

Get a sneak peek of your success with our US CPA Demo Certificate — a true-to-life preview of the official credential you’ll earn after completing the program.

Free Demo Class

To earn your CPA license, you'll need to clear four exam sections—three Core sections (mandatory for everyone), and one Discipline section (based on your career focus).

Exam Format: Time, Question Types, and Structure

| Section | Duration | MCQs | Task-Based Simulations (TBS) |

|---|---|---|---|

| AUD – Core | 4 hours | 78 | 4 |

| FAR – Core | 4 hours | 50 | 7 |

| REG – Core | 4 hours | 72 | 8 |

| BAR – Discipline | 4 hours | 50 | 7 |

| ISC – Discipline | 4 hours | 82 | 6 |

| TCP – Discipline | 4 hours | 68 | 7 |

Exam Scoring Breakdown

| Section | MCQs Weight | TBS Weight |

|---|---|---|

| AUD | 50% | 50% |

| FAR | 50% | 50% |

| REG | 50% | 50% |

| BAR | 50% | 50% |

| ISC | 60% | 40% |

| TCP | 50% | 50% |

Core Subjects Overview

| Content Area | Allocation |

|---|---|

| Ethics, Professional Responsibilities & General Principles | 15–25% |

| Risk Assessment & Planning | 25–35% |

| Performing Procedures & Evidence Collection | 30–40% |

| Forming Conclusions & Reporting | 10–20% |

Discipline Subjects Overview

| Content Area | Allocation |

|---|---|

| Business Analysis | 40–50% |

| Technical Accounting & Reporting | 35–45% |

| State & Local Government | 10–20% |

Academic Head | Board360

Continuous testing all year round

2-4 weeks for evaluation and application process

Most students clear all 4 parts within 12 months (some in 6th)

Master FAR and lay the foundation for success

Dive deep into AUD and sharpen your skills

Conquer REG with confidence and precision

Finish strong with your chosen discipline (BAR / ISC / TCP)

What is US CPA?

What is included in the US CPA exam?

Who can pursue the CPA qualification?

What’s the difference between CFA and CPA?

What should I do if I don’t meet the CPA course eligibility criteria?