Enrolled Agent

3 Parts | 6–12 Months | 95% Pass Rate

3 Parts | 6–12 Months | 95% Pass Rate

Board360 delivers the most comprehensive IRS Enrolled Agent certification solution to help you become a US tax expert and unlock global career opportunities.

Highest Pass Rate with structured learning support

Clear the EA Exams in as little as 6–12 months

IRS-approved study material powered by leading prep providers

Weekly live sessions led by industry experts

Unlimited access to recorded lectures and study tools

Complete Exam Guidance – from registration to exam scheduling

Real-World Tax Training with hands-on case studies

Pre-Annotated Digital Notes for faster learning

Internship Opportunities with US tax firms and partners

1:1 Mentorship and doubt-clearing with experienced faculty

Placement Support through Board360’s global network

Kind words from our successful students

Board360 made my EA journey so easy. The classes are simple to follow, and my mentor, Sagar Bajaj Sir, supported me at every step. I cleared my two exams on my first try, and they even helped me feel confident for my job interviews.

As a student, I found U.S. taxation really overwhelming, but Board360, an edtech platform, made it simple and approachable. Their EA program explained concepts clearly with practical examples, and the structured training helped me prepare confidently for the exam.

Board360, a leading learning platform, provided in-depth EA training that made complex topics easier to understand. With consistent guidance and mentorship from Sagar Sir, I was able to stay disciplined, focused, and fully exam-ready throughout my preparation.

Board360, learning platform, offered EA coaching that was highly focused and exam-oriented. With comprehensive mock tests and the guidance of mentors, even the most complex tax topics became easy to understand and confidently tackle.

At Board360 EA Prep, learning isn’t just about passing the IRS exams — it’s about unlocking global tax opportunities with the right tools, mentors, and community. From expert-led sessions to practical case studies and real-time collaboration, we make your EA journey smarter, simpler, and more engaging.

IRS-aligned questions, clear explanations, and smart tools trusted by aspiring EAs worldwide.

Get guidance from experienced tax professionals and EAs for concepts, exam strategy, and career growth.

Access accurate, IRS-approved EA materials in one organized platform.

Easily book 1:1 mentoring, doubt-clearing classes, and live workshops.

Engage with fellow EA aspirants, share knowledge, and learn together anytime.

We have redefined EA prep. With our award-winning study tools, you will master even the most complex U.S. tax topics. Our focus is on helping you understand, apply, and retain, not just memorize.

BOARD360 powered by HOCK International provides a structured, exam-focused approach to help you confidently prepare for all three parts of the IRS Special Enrollment Exam (SEE).

From accounting grads to finance professionals, thousands of learners rely on BOARD360’s EA prep. With practical questions and clear explanations, even the toughest IRS topics become manageable, helping you feel fully exam-ready.

Learn from experienced EAs and tax professionals who bring decades of real-world expertise, exam strategy, and mentorship to guide you through every step of your EA journey.

Tough tax rules? No problem. BOARD360’s EA questions come with detailed explanations, diagrams, flowcharts, and real-world IRS insights to simplify complex topics.

BOARD360 powered by HOCK International includes performance tracking, progress dashboards, interactive practice questions, and centralized study resources to strengthen learning and retention.

No fluff—just what matters. BOARD360’s EA study materials are expertly curated to make IRS tax laws and procedures easy to understand and quicker to master.

Study anytime, anywhere—on your commute, between work, or from home. All features, all access, all the time.

Practice with thousands of IRS-aligned questions written and reviewed by EA experts. Each question includes detailed explanations, concept breakdowns, and reinforcement through customizable flashcards, pre-annotated notes, and quick-review tools.

Prepare smarter with customizable flashcards, pre-annotated notes, and built-in highlighters—perfect for last-minute revisions before the SEE.

Get federally licensed as a U.S. tax professional by:

Your global qualifications are welcome! You may need extra steps if:

Free Demo Class

The SEE consists of three separate exam parts — all multiple‑choice — each designed to assess your knowledge of federal tax law and IRS procedures:

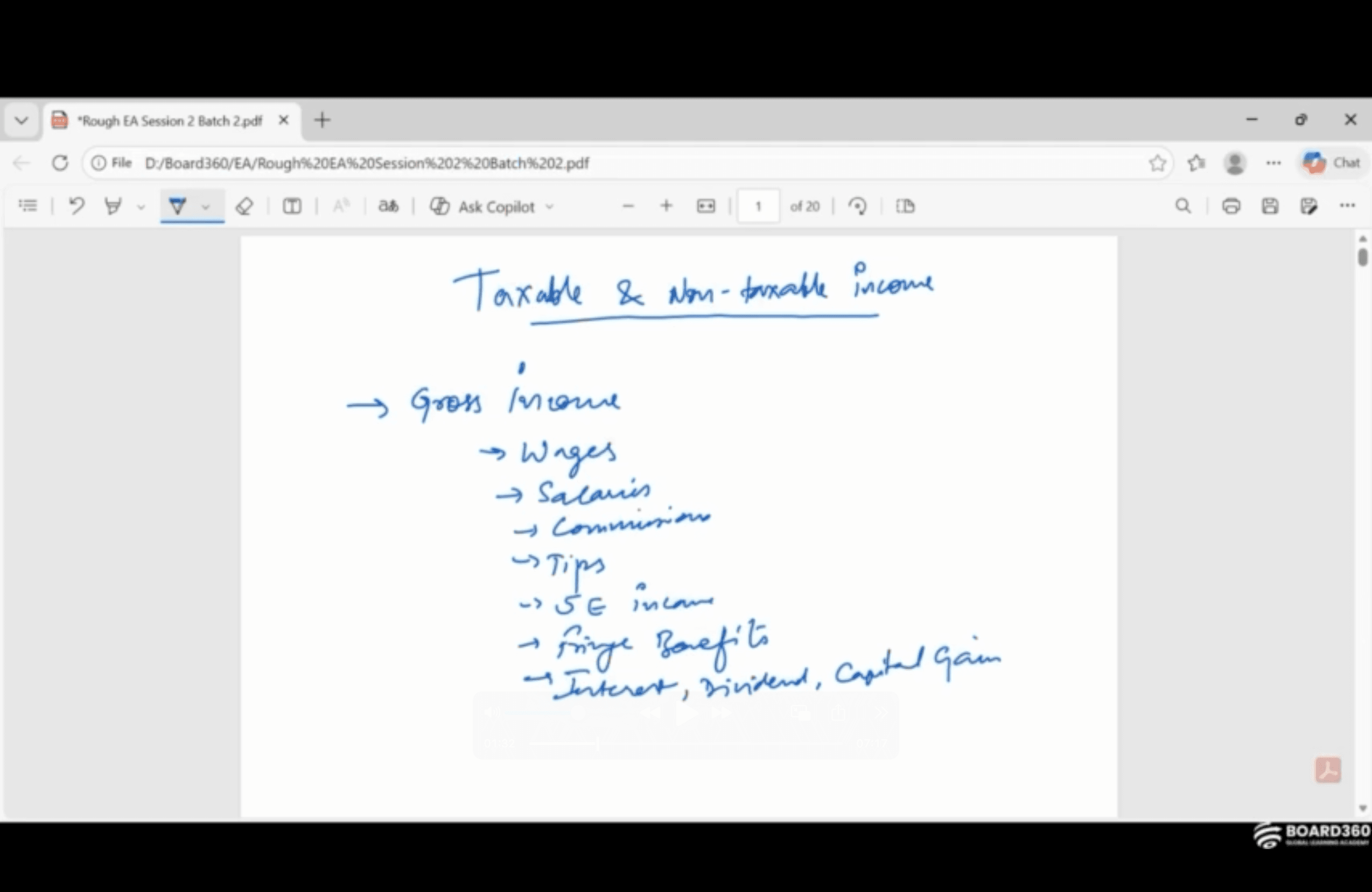

Focuses on individual federal income taxation, filing, income, deductions, credits, and related topics.

Covers business entities, business tax requirements, income, deductions, credits, and specialized business returns.

Tests your ability to represent taxpayers before the IRS, including IRS procedures, ethics, and professional responsibilities.

Exam Format: Time, Question Types, and Structure

| Part | Duration | MCQs |

|---|---|---|

| Part 1 – Individuals Taxation | 3.5 hours | 100 |

| Part 2 – Businesses Taxation | 3.5 hours | 100 |

| Part 3 – Representation, Practices & Procedures | 3.5 hours | 100 |

Exam Scoring Breakdown

| Part | Scored Questions | Experimental Questions | Passing Score |

|---|---|---|---|

| Part 1 – Individuals Taxation | 85 | 15 | Scaled score of 105 |

| Part 2 – Businesses Taxation | 85 | 15 | Scaled score of 105 |

| Part 3 – Representation, Practices & Procedures | 85 | 15 | Scaled score of 105 |

Part 1 Subjects Overview

| Content Area | Approximate Number of Questions |

|---|---|

| Preliminary Work & Taxpayer Data | ≈14 |

| Income & Assets | ≈17 |

| Deductions & Credits | ≈17 |

| Taxation & Advice | ≈15 |

| Specialized Individual Returns | ≈12 |

Part 2 Subjects Overview

| Content Area | Approximate Number of Questions |

|---|---|

| Business Entities & Considerations | ≈30 |

| Business Tax Preparation | ≈37 |

| Specialized Returns & Taxpayers | ≈18 |

| Filing Process | ≈14 |

Part 3 Subjects Overview

| Content Area | Approximate Number of Questions |

|---|---|

| Practices & Procedures | ≈25 |

| Representation Before the IRS | ≈25 |

| Specific Areas of Representation | ≈20 |

| Completion of Filing & Other Processes | ≈15 |

Key Exam Rules & Administration

You must obtain a PTIN to register for the SEE. You may take each exam part in any order. Each part is offered from May 1 through the end of February; there is a blackout period in March–April each year. Each part may be taken up to 4 times per testing window.

Passing scores for each part remain valid for 3 years from the date passed; you must pass all three within this period to apply for enrollment.

After passing all parts, apply for enrollment using IRS Form 23 and pass a suitability check, including compliance and background review.

Test any time during the May 1 – February 28/29 window each year. Exams are offered at authorized Prometric testing centers.

After registering with a valid PTIN, IRS authorization to schedule your exam typically takes 2–4 weeks.

Complete all 3 parts of the SEE within 3 years to qualify for EA licensure.

Focus on individual federal taxation: filing requirements, gross income, deductions, credits, and related topics.

Cover business taxation: entities, business income, deductions, credits, and specialized business returns.

Master IRS representation, ethics, professional responsibilities, collection procedures, audits, appeals, and taxpayer rights.

What is an Enrolled Agent (EA)?

Who can become an EA?

How do you become an Enrolled Agent?

What is the passing criteria for EA exam?

Can IRS employees skip the EA exam?